Iowa First Time Homebuyer Tax Credit. It's not a loan, and it's not a tax credit. Targeted areas of the state) with a mortgage credit certificate. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018.

All loans subject to a minimum 640 credit score. The short answer is, unfortunately, no. It's a cash payment made to eligible buyers.

Concerning With Iowa First Time Homebuyer Tax Credit

When you want to looking for iowa first time homebuyer tax credit images assistance connected with to your keyword, you have to visit the ideal blog. Our site frequently gives you suggestions for viewing the highest quality video and image content, please kindly surf, and locate more enlightening video articles and images that fit your interests.

In this article, we'll give whatever you need on iowa first time homebuyer tax credit. Starting from opinion concerning iowa first time homebuyer tax credit and a few sampling of portrait nearly it. At the end of this article, we hope that you will have passable counsel just about iowa first time homebuyer tax credit so that you can handle it as a basis for making current and in the future decisions.

For more information visit the iowa finance authority’s website. In a nutshell, it reduces your federal income taxes, creating additional income for you. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative.

Homeownership is something many families strive for, but it is difficult to save for a down payment on a first home. An addition five thousand dollars is available, too, according to the bill's draft version. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative.

For more information visit the iowa finance authority’s website. Iowa first time homebuyer tax credit

Iowa first time homebuyer tax credit. Borrowers who buy their homes using the firsthome or firsthome plus homebuyer programs may be subject to recapture tax. The firsthome and homes for iowans programs may provide eligible iowans with an affordable mortgage and down payment and closing cost assistance. All loans subject to a minimum 640 credit score. The short answer is, unfortunately, no.

Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan. Targeted areas of the state) with a mortgage credit certificate. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new homebuyers to get a tax credit of up t0 $7,500 during the first year of the initiative. For more information visit the iowa finance authority’s website.

Borrowers repay the government a portion of their gain on the sale of their home, depending on (1) whether there is a gain on the sale, (2) the household income at the time of sale, and (3) if the sale occurs within nine years of buying the home. The firsthomes tax credit is a great option to help new homebuyers save money. Stay informed, subscribe to receive updates. It's not a loan, and it's not a tax credit.

An addition five thousand dollars is available, too, according to the bill's draft version. The home must be occupied by the buyer as a primary residence within 60 days of closing. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. In a nutshell, it reduces your federal income taxes, creating additional income for you.

Homeownership is something many families strive for, but it is difficult to save for a down payment on a first home. An addition five thousand dollars is available, too, according to the bill's draft version.

However, if you can not find picts and information that related with iowa first time homebuyer tax credit mentioned above, you can try to find in the following another such as Why We Started The First Time Home Buyer Podcast - Episode 00 Firsttimehomebuyer Realestate Tech St First Time Home Buyers Podcasts Credit Repair Companies, How A First Time Homebuyers Saving Account Can Help You Buy Your First Home, First-time Homebuyer Programs In Kentucky 2021, What If My Co-purchaser And I Dont Both Qualify As First-time Homebuyers Ratehubca, What Is A First-time Homebuyer, and Tips For First-time Home Buyers What You Must Know Before You Buy. You can check our pictures gallery that related to iowa first time homebuyer tax credit below.

Iowa First Time Homebuyer Tax Credit Images Gallery

Following after first-time home buyer faq georgia department of community affairs get from www.dca.ga.gov with 450 x 700 pixels dimensions picture and jpg filetype. Borrowers who buy their homes using the firsthome or firsthome plus homebuyer programs may be subject to recapture tax. Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the.

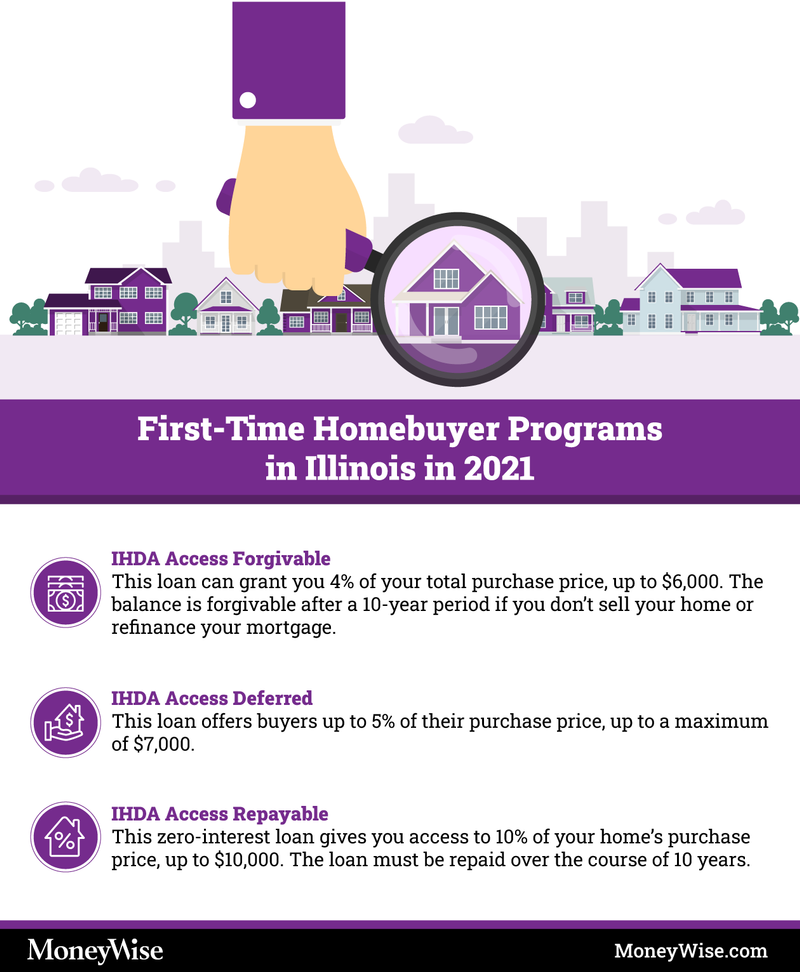

These after first-time homebuyer programs in illinois 2021 came from moneywise.com with 972 x 800 pixels dimensions picts and jpg filetype. Stay informed, subscribe to receive updates. Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan. Borrowers repay the government a portion of their.

Here about first-time homebuyer programs in ohio 2021 came from moneywise.com with 794 x 800 pixels dimensions photo and jpg filetype. All loans subject to a minimum 640 credit score. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which the eligible home costs.

These about first-time home buyer programs in 2021 came from moneywise.com with 1248 x 800 pixels dimensions image and jpg filetype. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. In a nutshell, it reduces your federal income taxes, creating additional income for you. Stay informed, subscribe to receive updates..

This over first-time home buyer seminar - members cooperative credit union came from www.membersccu.org with 2016 x 1584 pixels dimensions photo and jpg filetype. The short answer is, unfortunately, no. Every year, you’re granted a direct credit on your federal taxes of 50% of the annual interest you pay on your mortgage. Homeownership is something many families strive for, but it is difficult to.

These over first-time homebuyer programs in pennsylvania pa 2021 came from moneywise.com with 1093 x 800 pixels dimensions picture and jpg filetype. Homeownership is something many families strive for, but it is difficult to save for a down payment on a first home. Borrowers repay the government a portion of their gain on the sale of their home, depending on (1) whether.

Next over tips for first-time home buyers what you must know before you buy get from www.thetruthaboutmortgage.com with 354 x 610 pixels dimensions picture and png filetype. An addition five thousand dollars is available, too, according to the bill's draft version. Every year, you’re granted a direct credit on your federal taxes of 50% of the annual interest you pay on your mortgage. The short answer is,.

This concerning why we started the first time home buyer podcast - episode 00 firsttimehomebuyer realestate tech st first time home buyers podcasts credit repair companies came from www.pinterest.com with 1540 x 1540 pixels dimensions picts and png filetype. Stay informed, subscribe to receive updates. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. In a nutshell, it reduces your federal income taxes, creating additional income for you..

Following after iowa ia first-time home buyer programs for 2019 - smartasset came from smartasset.com with 400 x 728 pixels dimensions image and jpg filetype. Borrowers who buy their homes using the firsthome or firsthome plus homebuyer programs may be subject to recapture tax. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of.

Here after how a first time homebuyers saving account can help you buy your first home get from education.bankerstrust.com with 1098 x 720 pixels dimensions picture and png filetype. Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan. Iowa residents will be able to take advantage of the new tax credit on.

Its over what if my co-purchaser and i dont both qualify as first-time homebuyers ratehubca originated from www.ratehub.ca with 218 x 300 pixels dimensions picture and png filetype. Iowa residents will be able to take advantage of the new tax credit on deposits made after jan. Stay informed, subscribe to receive updates. Borrowers who buy their homes using the firsthome or firsthome plus homebuyer programs may be subject.

Next about common mistakes that first-time home buyers make buying first home first home buyer first time home buyers taken from www.pinterest.com with 1096 x 735 pixels dimensions picts and png filetype. It's a cash payment made to eligible buyers. The home must be occupied by the buyer as a primary residence within 60 days of closing. Created as a response to the 2008 financial crisis, the housing and economic recovery act.

Next after what is a first-time homebuyer came from www.fha.com with 360 x 640 pixels dimensions image and png filetype. Borrowers repay the government a portion of their gain on the sale of their home, depending on (1) whether there is a gain on the sale, (2) the household income at the time of sale, and (3) if the sale.

Here concerning rhs loan taken from www.pinterest.com with 1056 x 816 pixels dimensions photo and png filetype. The home must be occupied by the buyer as a primary residence within 60 days of closing. In a nutshell, it reduces your federal income taxes, creating additional income for you. Stay informed, subscribe to receive updates. Borrowers repay the.

Here over the 5 cs of credit and what they mean for your agricultural land loan - agamerica land loan the borrowers credits originated from www.pinterest.com with 700 x 1160 pixels dimensions image and jpg filetype. The short answer is, unfortunately, no. (1) the date on which the individual is named as a designated beneficiary of a fthsa and (2) the date of the qualified home purchase for which the eligible home costs are paid or..

Next about what is bidens 15000 first-time homebuyer act get from www.directmortgageloans.com with 576 x 864 pixels dimensions image and png filetype. Iowa’s mortgage credit certificate program (mcc) allows homebuyers to save up to $2,000 every year on their federal taxes for the life of their mortgage loan. Every year, you’re granted a direct credit on your federal taxes of 50% of.

Next about first-time homebuyer programs in kentucky 2021 came from moneywise.com with 1121 x 800 pixels dimensions picts and jpg filetype. The firsthomes tax credit is a great option to help new homebuyers save money. Iowa residents will be able to take advantage of the new tax credit on deposits made after january 1, 2018. Created as a response to the.

Here concerning first-time homebuyer programs in iowa 2021 get from moneywise.com with 1219 x 800 pixels dimensions photo and png filetype. For more information visit the iowa finance authority’s website. In a nutshell, it reduces your federal income taxes, creating additional income for you. Iowa residents will be able to take advantage of the new tax credit on deposits made after.

Its concerning pin on first time home get from ar.pinterest.com with 414 x 556 pixels dimensions picts and png filetype. The firsthome and homes for iowans programs may provide eligible iowans with an affordable mortgage and down payment and closing cost assistance. Created as a response to the 2008 financial crisis, the housing and economic recovery act (hera) allowed new.

Here concerning first-time home buyer seminar - members cooperative credit union taken from www.membersccu.org with 8636 x 6900 pixels dimensions photo and jpg filetype. Stay informed, subscribe to receive updates. Every year, you’re granted a direct credit on your federal taxes of 50% of the annual interest you pay on your mortgage. For more information visit the iowa finance authority’s website. An addition five.

Conclusion!

Have you got every the instruction you need. Have you got any extra ideas about this iowa first time homebuyer tax credit. If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram, and so on or you can also save this blog page with the title iowa first time homebuyer tax credit by using Ctrl + D for devices like a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it's a Windows, Mac, iOS, or Android operating system, you will still be able to bookmark this website.